Online shoppers today take advantage of several digital banking products. And although a lot of people are familiar with such services from the US and European markets, only a few people know about digital banking products in Canada. KOHO is one of them and today we will talk to you, our users, about how you can find great products and deals in Canada using the app! We will also tell you how you can get good cash back using KOHO.

A maximum of $16 cash back is on offer right now. Click it and start saving money now.

What is KOHO?

KOHO Financial Inc. operates under KOHO Digital Banking Company, a financial technology company headquartered in Toronto, Canada. They aim to provide a solution to traditional but cumbersome banking services that come with various hidden fees. The

company itself does not have banking accreditations and is funded by the Canadian Trust Company.

How to use KOHO?

Using KOHO is very simple. You can add funds to a KOHO account in three ways:

(1) Electronic transfer from a regular bank account;

(2) Transfer funds through an existing VISA debit card, or directly deposit the pay stubs for work into a paycheck (called direct deposit); or

(3) Use your KOHO card just like any debit card when you shop at a physical store or online store.

Also, KOHO runs on the VISA system so merchants can conduct transactions like ordinary credit card transactions.

The Difference Between KOHO and a Debit Card

The biggest difference is that KOHO is a digital bank that provides users with financial authorization instead of customers having to withdraw money from traditional ATMs. (You can still use your KOHO card on any online ATM at no charge). This way, KOHO maintains low operating costs and converts these saved costs into cash back to users.

In addition, if you register for a KOHO Premium account, you can get at least a 0.5% rebate on all purchased goods and at least 2% of cash rebate in 3 main categories of goods or transactions. You can get even greater benefits with KOHO brand partner merchants.

Why Should I Use KOHO?

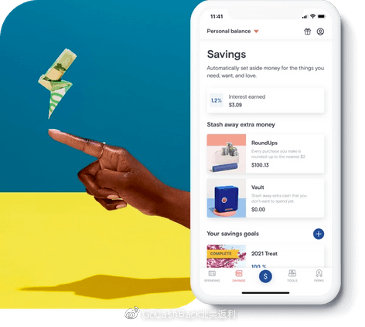

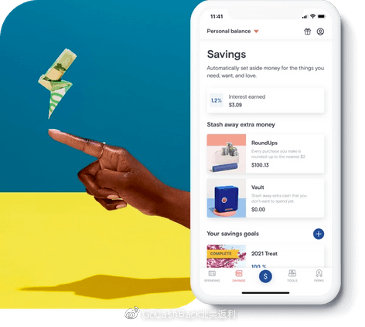

KOHO has invested a lot of research time to make its app very simple and easy to use. There are in-app features that would allow users flexibility and convenience in making financial transactions. KOHO is also constantly being upgraded and improved--updates and fixes on the KOHO app are rolled out once every three weeks. Frankly speaking, this is not what most banks can do! Most banks usually release a new version of the update once a year.

What Else Can KOHO Do for Me?

There are plenty more! We recommend the Powerups cashback function in it in-app! After three days of consumption, the rebate will be generated, and then it can be withdrawn to the available balance of the account in real-time. We are sure this is good news to all our loyal customers.

In general, KOHO's digital banking product focuses on consumer cashback, which is very suitable for users who want to go online shopping in Canadian stores. Using the app is smooth and seamless. Try it and don’t forget to avail of a $16 cash back from GoCashBack. Click and start saving money now!

United States

Hong Kong(China)

Australia

Canada

United Kingdom

Korean

Korean

Stores

Stores Deals

Deals

Travel

Travel Editor's Guide

Editor's Guide 1st Order Bonus

1st Order Bonus