Tax filing season in the United States starts at the beginning of the year until the 15th of April. The Internal Revenue Service (IRS) encourages taxpayers to plan ahead. After all, tax filing is really a very complicated and time-consuming project. Last year was postponed to mid-May due to the epidemic. Wonder if this year will also be affected by the epidemic. With 2022 coming in, it’s best to start doing your homework ahead of time to avoid delays in tax processing and tax refunds. Click to know more

Today, I will talk to you about how to report taxes and save money. How to file taxes efficiently? Do you really need tax filing services? How should you choose tax filing software and accountants? Keep reading to know more!

Do you really need tax filing services?

If you’re single, have a single source of income, and your annual income is below $69,000, you can use the free online form recommended by IRS: Click here

How should tax preparation software and accountants choose?

Why do people spend money to file tax returns with an accountant? Because the accountant knows all kinds of tax regulations, reasonable tax avoidance and tax reduction based on your stocks, real estate, funds, and other financial sideline business conditions, check which deductions and credits can be applied for, so as to help you reduce the tax amount and get the most tax refund. When the tax rebate you can receive (or reduce the amount of tax to be paid) is less than the cost of paying the accountant, it’s a big reduction! However, for ordinary employees and practitioners with a single source of income, it is highly recommended that you use various online tax filing service websites and save on costs. Online tax filing not only costs the least money, but it may even be free. The online tax filing service in the United States is also relatively mature and flexible. It does not cost a penny until the last minute of the order submission. Combined with various activities at the end of the year + various high rebates, online filing can save you money and relieve you of your worries.

Next, we will give you a brief introduction to the various benefits and rebate activities of various tax filing websites this year. Read on for details and pick your best choice.

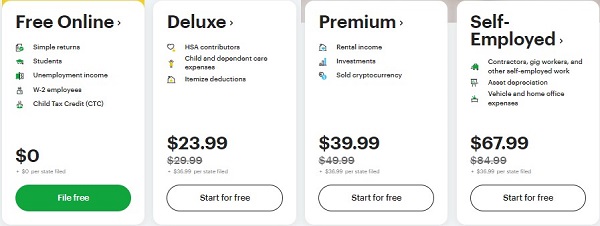

【H&R Block: TS22 Standard Discount + 1% Cash Back】Click and shop to buy>>

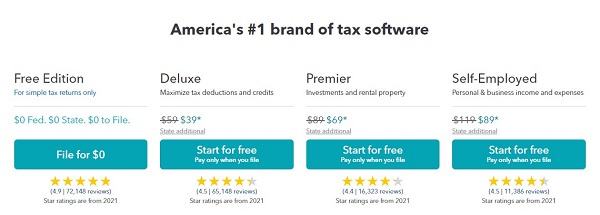

I would like to ask my friends in the United States, who among you have never seen or heard of H&R Block? It’s a very large tax filing company with many physical offices. The advantage of dealing with this company is that the process is very clear and professional. There are many different price points, according to your situation. For an additional cost, you can avail of more specialized services.

Compared with TurboTax, H&R Block's biggest advantage is that it has a solid office network and customer service support. In addition to online and telephone support, the ability to provide face-to-face customer support and service is definitely the biggest difference between H&R Block and other tax preparation software. If you use other services (even the free version) and are reviewed by the IRS, they can send an agent to help you prepare the review materials and even handle tax review issues on your behalf. If you use other software, such services usually require additional fees.

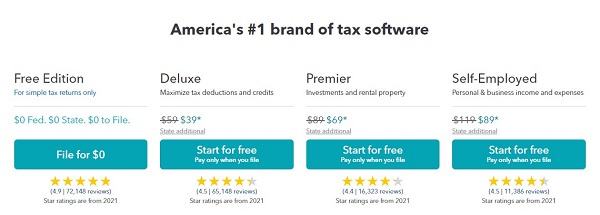

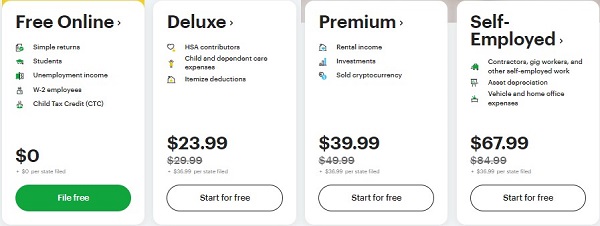

【TurboTax: $39-$89 + US 10% Cash Back】Click and shop to buy>>

Turbo Tax allows users to file their own taxes. There’s also TurboTax Live (expert assistance); and even TurboTax Live Full Service (experts). The main difference between the three lies in the support they offer, which is roughly as follows:

1. Filing your own taxes: find answers to all your questions after logging in by yourself. You have access to a knowledge database for any inquiries about tax filing.

2. Expert assistance: Turbo Tax's Experts will answer your questions and can also help you review before submitting.

3. Experts: You take photos of your tax documents and upload them, and Turbo Tax experts will help you file your tax returns.

Whether you are filing taxes yourself, downloading software, expert assistance, or expert responsibility (similar to H&R Block), you can also choose Free/Basic Basic Edition, Deluxe Edition, Premier Edition, and Home & Business Self-Employed Edition.

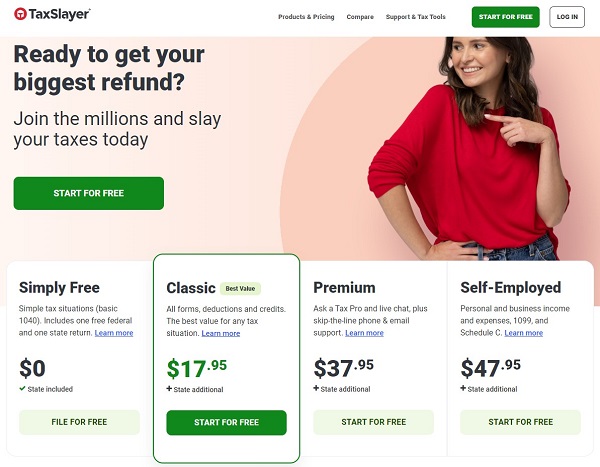

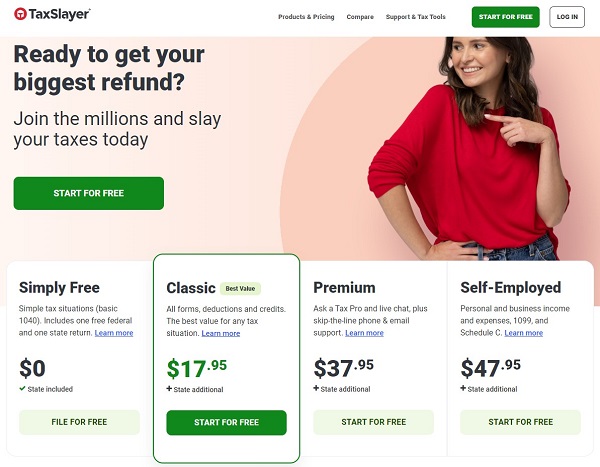

【Tax Slayer: $17.95-$47.95 + up to 8% Cash Back】Click and shop to buy

The price is relatively the lowest among these few, and you can upload the W-2 form directly. The operation is very simple. The premium version has the function of manual service. The manual service makes the whole process much easier. The deluxe is expensive. The price is indeed conscientious, and now there is a maximum of 8% Cash Back when placing an order.

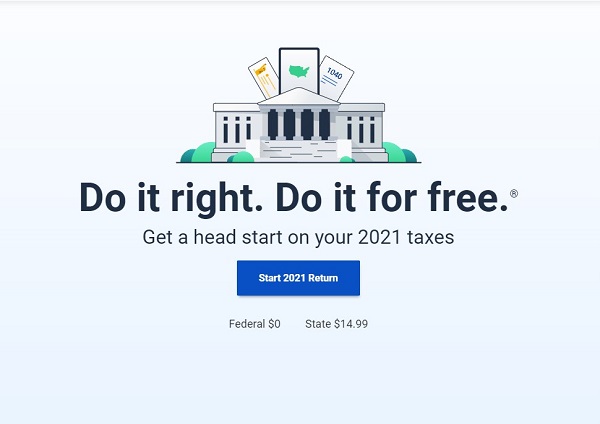

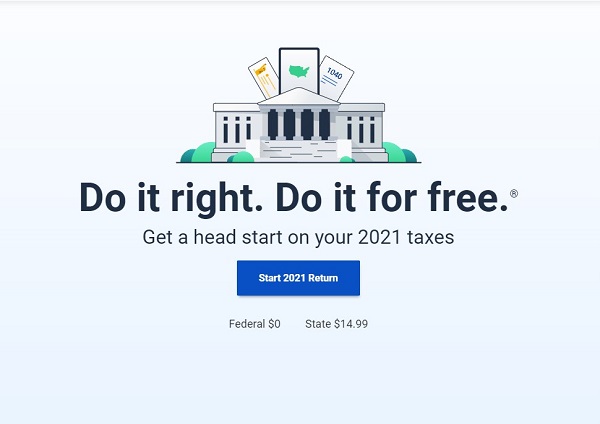

【FreetaxUSA: Federal $0 & State $14.99 + 13.0% high rebate】Click and shop to buy

FreeTaxUSA is an online tax filing service company founded in 2001 by a certified public accountant and a group of professional software developers. Their expertise in tax declaration and software development has made FreeTaxUSA the fastest-growing online tax service company in the United States today. This website is very direct, convenient, and easy to operate. There are no big fancy terminologies and the format and content are very clear. You can fill in your federal taxes for free, but state taxes need to be paid, and the price is $14.99. Currently, it doesn’t allow you to upload W-2 directly, but you can upload the tax forms declared by TurboTax, H&R Block, and TaxAct. It is also smarter.

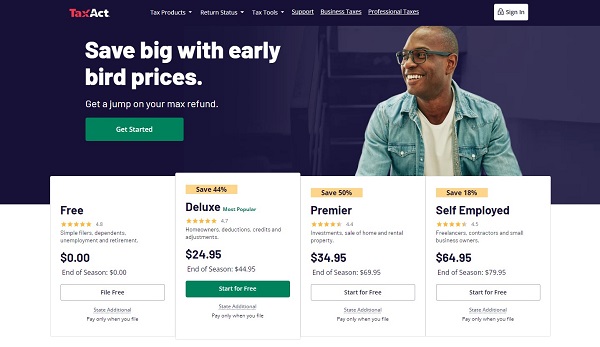

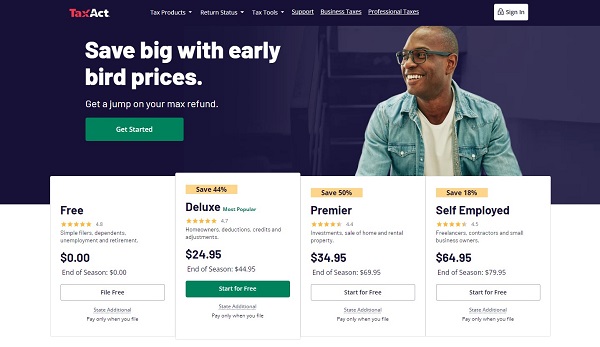

【TaxAct: As low as 50% off Premier + 8% Cash Back】Click and shop to buy

Different tax filing websites have their own characteristics and benefits. TaxAct is different from TurboTax in that it will let you choose a tax filing method according to your own situation. Costs are more affordable as well. The function of this website is relatively simple. Just choose your situation and then you can complete the tax declaration step by step. It is also a very large and formal tax declaration company on the market. If you feel that TurboTax is a bit expensive and you're not sure about your situation, we recommend choosing a paid package with TaxAct.

That’s all about tax filing online services available in the US. If you want to save money, choose carefully according to your needs. You are also welcome to discuss your favorite tax filing software in the comment section. Are you going to continue to use the same version this year, or do you want to change to a cheaper one? If there are other business recommendations, you can also leave a message in the comment area. We’d love to hear about your personal experiences!

United States

Hong Kong(China)

Australia

Canada

United Kingdom

Korean

Korean

Stores

Stores Deals

Deals

Travel

Travel Editor's Guide

Editor's Guide 1st Order Bonus

1st Order Bonus